Background

A leading Fast-Moving Consumer Goods (FMCG) brand in Australia sought to enhance its in-store execution across grocery stores by gaining detailed insights into shelf layouts, product availability, and competitor positioning. The company aimed to boost sales and refine its merchandising strategies while addressing significant variances in sales performance across stores. At the store level, their market share was more than 20 points higher in top-performing locations compared to the bottom tier.

To uncover the key drivers of sales performance and optimize its Perfect Store strategy, the brand partnered with Wiser. Leveraging Wiser’s crowdsourced shoppers, the brand conducted in-depth shelf-level analysis, gaining valuable insights into category dynamics. By correlating store performance with planogram KPIs, the brand refined its approach and effectively closed performance gaps.

Challenges

Effective use of physical space is critical for success in retail. Factors like share of shelf, shelf position, product range, on-shelf availability, and shelf layout can significantly influence sales. However, challenges in visibility, execution, and resources often hinder optimization efforts. These were the key challenges faced by this FMCG brand:

- Limited Visibility:

The brand lacked detailed data on product placement, shelf share, and competitor arrangements at the SKU level. Without robust data collected at store level, the brand struggled to optimize planograms and drive category growth. - Inconsistent Execution:

Variations in shelf layouts and product positioning across stores resulted in inconsistent brand representation and sales losses. Although the assortment was meant to be standardized across all stores through a centralized negotiation, the brand had no clear understanding of what caused the high variance in store-level performance. - Resource Constraints:

With thousands of stores to oversee, conducting audits required substantial time, manpower, and coordination. Store visits were labor-intensive, and the insights gained were often delayed or incomplete, making it difficult to get a real-time understanding of in-store conditions.

These challenges underscored the need for a data-driven approach to optimize in-store execution and drive consistent performance across locations.

Solution

The FMCG brand leveraged Wiser’s Retail Intelligence:

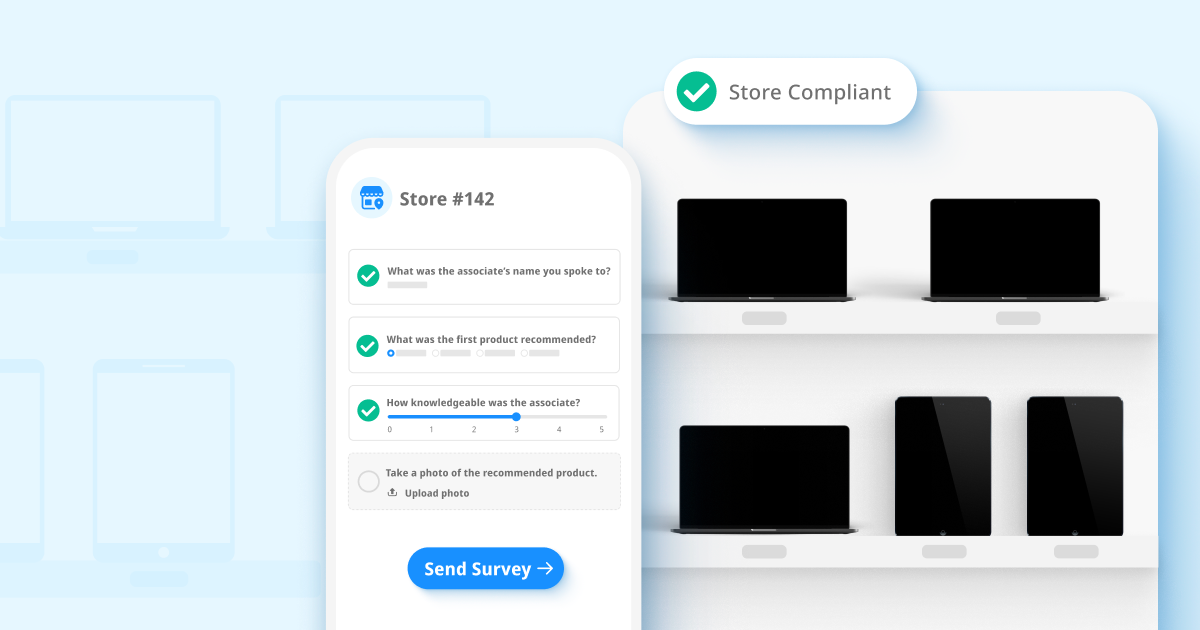

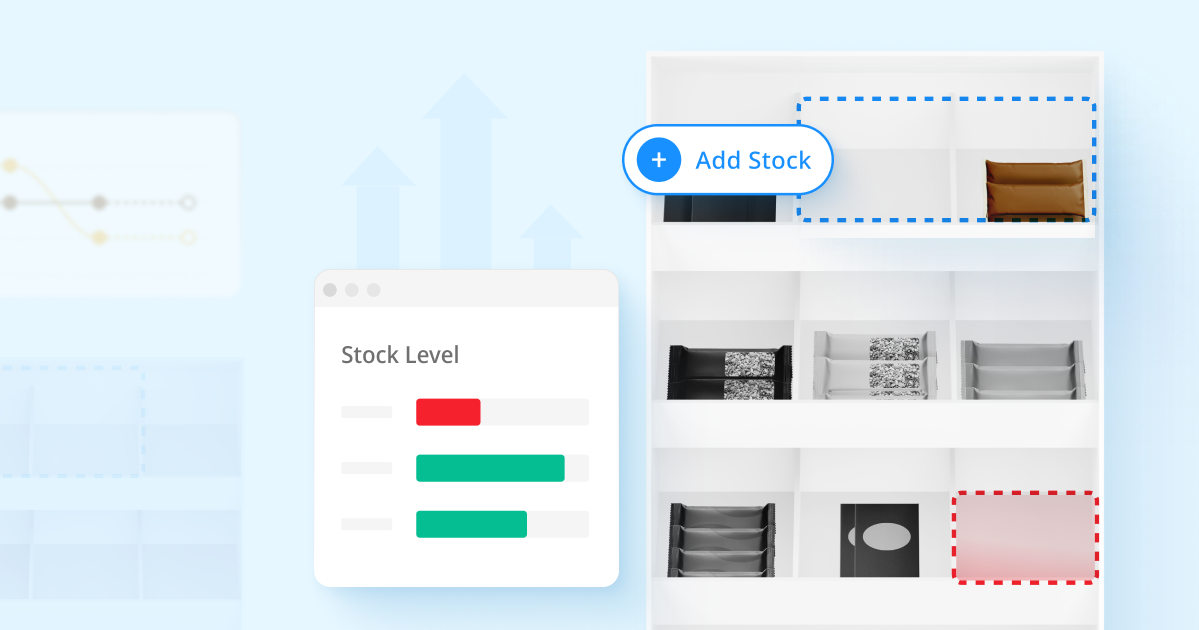

- Crowdsourced Data Collection:

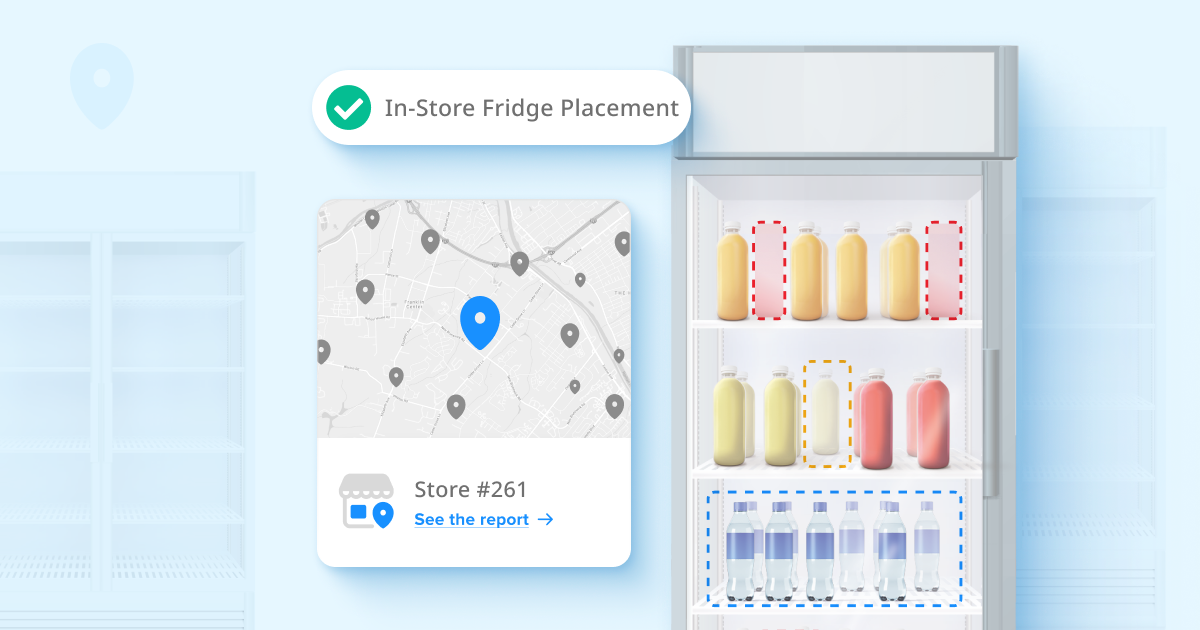

Wiser’s community of mystery shoppers visited grocery stores across the country, capturing high-resolution images and recording data at SKU level. These visits provided valuable insights not only into the brand’s own products, but also into competitor offerings, enabling a comprehensive analysis of category dynamics and competitive positioning. - Detailed In-Store Mapping:

The data collected was analyzed to create a clear picture of in-store performance and merchandising execution. Key focus areas included:- Product Ranging: Determined the availability and placement of top-performing SKUs, identifying gaps and opportunities to ensure key products were consistently on shelves.

- Shelf Layouts: Assessed how products were organized within aisles, including brand blocking, aisle flow, and shelf organization. This allowed the brand to evaluate whether its products were positioned effectively to attract customer attention and drive purchases.

- Share of Shelf: Measured the brand’s shelf presence in relation to competitors, both at the overall category and more granular sub-category levels. This provided actionable insights to help the brand improve its shelf space allocation and visibility.

- Macro-Space Indicators: Evaluated broader shelf dynamics, such as the number of bays allocated to each category and sub-category, to ensure optimal utilization of retail space. This helped the brand identify opportunities to negotiate better placement or increased space for its products.

Results

The FMCG brand leveraged Wiser’s Retail Intelligence to compare top and bottom-performing stores, identifying the impact of key performance indicators (KPIs) on sales. This data-driven approach delivered several critical outcomes:

- Identified Key Performance Indicators (KPIs):

The brand identified which shelf and merchandising factors, such as product placement, shelf layouts, and macro-space elements (e.g., bay allocation or shelf counts on fixtures), most significantly influenced sales performance. This guided their focus on high-impact areas to drive improvements. - Mobilized Field Teams and Enhanced Execution:

Based on prioritized KPIs, field teams were directed to address specific in-store execution issues, including share of shelf inconsistencies, planogram deviations, and eye-level placement of top-performing SKUs. Optimized shelf layouts and product placement improved visibility and accessibility, directly increasing sales. - Established Recurring Tracking and Data-Driven Decisions:

Recurring monitoring of perfect store KPIs ensured consistent execution and continuous improvement across stores. Real-time insights enabled strategic adjustments in merchandising and inventory management, tailoring actions to store-level conditions rather than relying on static, standardized planograms. - Improved Operational Efficiency and Sales Performance:

Automated data collection and analysis replaced time-consuming manual audits, saving resources and allowing the brand to focus on impactful improvements. These actions, supported by Wiser’s analysis, highlighted that macro-space elements were key drivers of sales performance. - Enhanced collaboration with Retail Partners:

Used insights to engage in fact-based discussions on planogram optimization, ensuring fair share of shelf across the network and redefining the Perfect Store strategy to enhance shopper experiences and drive sustainable sales growth.

By prioritizing store-level tracking and actionable insights, the FMCG brand was able to close performance gaps, improve execution, and secure a stronger market presence. This approach demonstrated the value of adapting strategies to reflect real-world store environments, laying the groundwork for long-term success.

Want help launching your own Perfect Store initiative? Get in touch with us.